Highlights of Bangladesh Budget (2024-2025)

The Bangladesh budget for the fiscal year 2024-25 brings several significant changes compared to the previous year. This budget aims to address economic challenges while fostering growth and development. Key differences from the last fiscal year include increased allocations for infrastructure projects, adjustments in tax policies, and a focus on social welfare programs. Let’s delve into the specifics of the new budget and what it means for the country’s economy and its citizens.

Operating & Development Budget

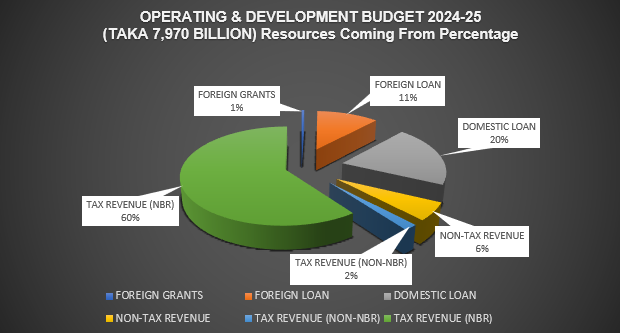

The 2024-25 budget has been designed to balance operating expenses and development initiatives. The operating budget, which covers the day-to-day expenses of running the government, has seen a modest increase to accommodate rising costs in public services. On the other hand, the development budget has received a significant boost to support ongoing and new infrastructure projects, including transportation networks, energy projects, and digital infrastructure. The government has allocated a substantial portion of the budget to education and healthcare, emphasizing the need to improve these critical sectors. Additionally, there are targeted investments in technology and innovation, aiming to drive future economic growth.

| OPERATING & DEVELOPMENT BUDGET 2024-25 (TAKA 7,970 BILLION) Resources Coming From | ||||

| Percentage | BDT Amount in Billion | |||

| FOREIGN GRANTS | 0.50% | 39.85 | ||

| FOREIGN LOAN | 11.40% | 908.58 | ||

| DOMESTIC LOAN | 20.20% | 1,609.94 | ||

| NON-TAX REVENUE | 5.80% | 462.26 | ||

| TAX REVENUE (NON-NBR) | 1.90% | 151.43 | ||

| TAX REVENUE (NBR) | 60.20% | 4,797.94 | ||

| 100.00% | 7,970.00 | |||

Tax Revenue (NBR)

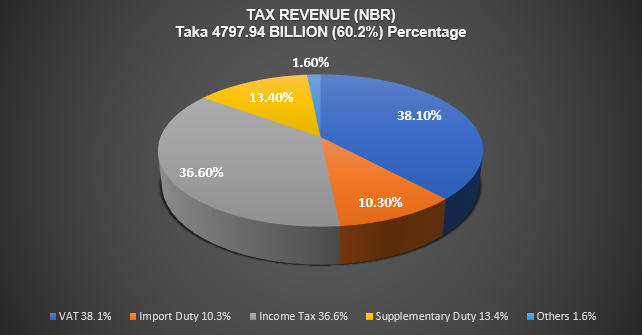

The National Board of Revenue (NBR) has set ambitious targets for tax collection in the fiscal year 2024-25. The focus is on broadening the tax base and improving compliance to increase revenue. Measures include better enforcement of existing tax laws, introduction of new taxes in certain areas, and enhanced use of technology to track and collect taxes. A significant portion of the revenue will come from Value Added Tax (VAT), customs duties, and income taxes. The NBR is also looking to streamline the tax filing process to make it more user-friendly and efficient for taxpayers.

| TAX REVENUE (NBR) Taka 4,800 BILLION (60.2%) | ||||

| Percentage | BDT Amount in Billion | |||

| VAT 38.1% | 38.10% | 1,828.02 | ||

| Import Duty 10.3% | 10.30% | 494.19 | ||

| Income Tax 36.6% | 36.60% | 1,756.05 | ||

| Supplementary Duty 13.4% | 13.40% | 642.92 | ||

| Others 1.6% | 1.60% | 76.77 | ||

| 100.00% | 4,797.94 | |||

Personal Income Tax

The personal income tax structure for the fiscal year 2024-25 has been revised to enhance progressivity, aiming to alleviate the tax burden on lower-income groups while ensuring that higher-income individuals contribute more. The government has increased the exemption limits for senior citizens, individuals with disabilities, and freedom fighters, providing additional relief to these specific groups. Tax filing procedures have been streamlined to make compliance easier and more efficient for taxpayers. These changes reflect a commitment to creating a fairer tax system that supports social equity and economic growth. As a result, the revised tax policy aims to balance the need for revenue generation with the goal of protecting vulnerable segments of the population.

The rate of personal income tax is proposed to be updated as follows:

| Amount of Taxable Income | |||

| Existing | Rate | Proposed | Rate |

| First Tk. 350,000 or as applicable | Nil | First Tk. 350,000 or as applicable | Nil |

| Next Tk. 100,000 | 5% | Next Tk. 100,000 | 5% |

| Next Tk. 300,000 | 10% | Next Tk. 400,000 | 10% |

| Next Tk. 400,000 | 15% | Next Tk. 500,000 | 15% |

| Next Tk. 500,000 | 20% | Next Tk. 500,000 | 20% |

| On the balance | 25% | Next Tk. 2,000,000 | 25% |

| On the balance | 30% | ||

Exemption

The exemption limit for specific cases remains unchanged from last year as follows:

- Female taxpayers and taxpayers at the age of 65 years or above will enjoy tax exemption up to Tk. 400,000.

Taxpayers of third gender and with a disability will enjoy tax exemption up to Tk. 475,000. - Gazetteer freedom fighters will enjoy tax exemption up to Tk. 500,000.

- Parents or legal guardians of disabled individuals will enjoy a further exemption of BDT 50,000 in addition to their existing limit of tax exempted income. If both parents of a disabled individual are taxpayers, then one of them will be eligible for this increased limit of exemption.

***Individuals having assets more than Tk. 50 lacs (previously Tk. 40 lacs) will now be required to furnish a “Statement of Assets and Liabilities” at the time of tax return filing.

Surcharge

Any individual taxpayer whose total net worth as per their Personal Balance Sheet and Lifestyle Statement exceeds the permissible limit will be subject to a surcharge on income tax in the following manner:

| Net Worth | ||

| Particular | Existing | Proposed |

| Up to Tk. 40,000,000 | Nil | Unchanged |

| Tk. 40,000,001 to Tk. 100,000,000 or owns more than one motor car in his/her name, or Owns property of more than 8,000 square feet in any city corporation area | 10% | |

| Tk. 100,000,001 to Tk. 200,000,000 | 20% | |

| Tk. 200,000,001 to Tk. 500,000,000 | 30% | |

| Above Tk. 500,000,000 | 35% | |

Corporate Income Tax

The corporate income tax rates for the fiscal year 2024-25 have been adjusted to foster business growth and investment. Publicly traded companies will maintain their tax rate at 25%, while non-publicly traded companies will continue to pay 32.5%. To stimulate entrepreneurship, the government has introduced specific incentives for small and medium-sized enterprises (SMEs) and startups, including tax holidays and reduced rates for new businesses. Additionally, targeted incentives for key sectors such as IT and renewable energy aim to promote innovation and sustainable development. These measures are designed to create a more favorable business environment, encouraging economic expansion and job creation.

Rates of Corporate Tax:

| Description | Existing | Proposed | Applicable tax rate if fails to meet the condition |

| A publicly traded company that issues shares worth more than 10 percent of its paid-up capital through an Initial Public Offering (IPO) | 20.00% | Unchanged | 22.50% |

| A publicly traded company that issues shares worth ten percent or less than ten percent of its paid-up capital through an IPO | 22.50% | Unchanged | 25.00% |

| Non-publicly traded company | 27.50% | 25.00% | 27.50% |

| One Person Company (OPC) | 22.50% | 20.00% | 22.50% |

| Publicly traded banks, insurance, and financial institutions (except merchant banks) | 37.50% | Unchanged | Condition not applicable |

| Non-publicly traded banks, insurance, and financial institutions (except merchant banks) | 40.00% | Unchanged | Condition not applicable |

| Merchant bank | 37.50% | Unchanged | Condition not applicable |

| Companies and entities other than the company producing all sorts of tobacco items including cigarettes, bidi, chewing tobacco, and gull | 45% + 2.5% (Surcharge) | Unchanged | Condition not applicable |

| Publicly traded mobile operator company | 40.00% | 45.00% | Condition not applicable |

| Non-publicly traded mobile operator company | 45.00% | Unchanged | Condition not applicable |

| Recognized Provident Fund, Approved Gratuity, Superannuation and Pension Fund | 15.00% | Unchanged | Condition not applicable |

| Trusts, funds (other than above), the association of persons, and other taxable entities | 27.50% | Unchanged | Condition not applicable |

| Co-operative societies registered under the Co-operative Societies Act, 2001 | 15.00% | 20.00% | Condition not applicable |

| Private university, private medical college, private dental college, private engineering college, or private college solely dedicated to imparting education on ICT | 15.00% | Unchanged | Condition not applicable |

infinigent consulting Ltd

infinigent Consulting Ltd. is a multinational strategic management consulting firm operating in India, Canada, and Bangladesh, with plans to expand to Singapore and Dubai. Our diverse team of international and local experts delivers tailored solutions to address business challenges. By closely collaborating with clients, we focus on improving organizational performance through customized, effective strategies.