Concept Note On A Comprehensive Framework for Acquisition Processes in Bangladesh

A Clear Guide to Know, How Acquisition Works:

An acquisition occurs when one company purchases a controlling stake in another company, either through equity ownership or asset transfer. It is a strategic business move aimed at achieving various goals, such as expanding operations, increasing market share, accessing new technologies, or entering new markets. Acquisitions are often used by organizations to gain a competitive advantage, reduce competition, or enhance operational efficiency.

This process involves careful evaluation of the target company’s financial and operational performance, compliance with legal and regulatory requirements, and strategic planning to ensure seamless integration. In the context of Bangladesh, acquisitions may be influenced by local market conditions, industry trends, and regulatory frameworks, making thorough planning essential for a successful transaction.

Example:

An acquisition occurs when one company purchases a controlling stake in another company, either through equity ownership or asset transfer. It is a strategic business move aimed at achieving various goals, such as expanding operations, increasing market share, accessing new technologies, or entering new markets. Acquisitions are often used by organizations to gain a competitive advantage, reduce competition, or enhance operational efficiency.

This process involves careful evaluation of the target company’s financial and operational performance, compliance with legal and regulatory requirements, and strategic planning to ensure seamless integration. In the context of Bangladesh, acquisitions may be influenced by local market conditions, industry trends, and regulatory frameworks, making thorough planning essential for a successful transaction.

2. Acquisition Process:

The acquisition process consists of six essential steps aimed at ensuring a smooth and efficient transition. These steps are:

Step-1

2.1. Strategic Planning, Target Identification, and Initial Research in Acquisitions in Bangladesh:

Strategic Planning, Target Identification, and Initial Research in acquisitions in Bangladesh involve a meticulous process aimed at identifying and evaluating potential acquisition targets that align with a company’s strategic objectives. This process typically involves the following steps:

- Defining Clear Strategic Objectives and Financial Goals: Establishing specific, measurable, achievable, relevant, and time-bound (SMART) goals for the acquisition. This includes identifying the desired outcomes, such as market share expansion, revenue growth, or cost reduction.

- Identifying Potential Target Companies: Conducting market research to identify companies that operate in industries or sectors aligned with the strategic objectives. This involves analyzing industry trends, competitive landscapes, and potential growth opportunities.

- Conducting Thorough Due Diligence: Conducting in-depth assessments of potential targets, including financial, legal, and operational reviews. This involves analyzing financial statements, legal documents, and operational processes to identify potential risks and opportunities.

- Evaluating the Potential Risks and Rewards: Assessing the potential risks and rewards associated with the acquisition, considering factors such as market competition, regulatory environment, and economic conditions in Bangladesh.

By carefully considering these factors, companies in Bangladesh can make informed decisions about potential acquisitions and increase their chances of success.

The Consequences of Neglecting Step 1 in the Acquisition Process:

- Misaligned acquisitions lead to poor integration.

- Wrong target selection causes inefficiency and cultural issues.

- Inadequate financial checks result in overpayment or hidden costs.

- Skipping legal due diligence exposes legal risks.

- Lack of operational review disrupts integration.

- Poor cultural alignment causes resistance and morale issues.

- Incomplete market research leads to missed opportunities.

- Inadequate risk analysis exposes unforeseen challenges.

- Poor planning wastes resources and reduces returns.

Step-2

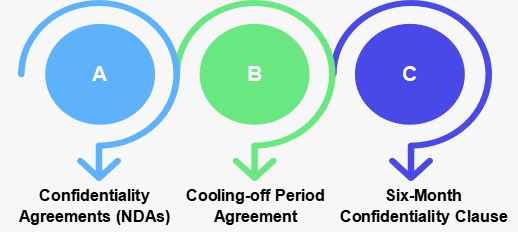

2.2. Basic Agreements to Start the Acquisition Process:

Several agreements play a critical role in safeguarding the acquisition process by setting clear guidelines, expectations, and legal protections for both parties involved. These agreements help navigate the complexities of an acquisition, ensuring transparency, security, and alignment.

A. Confidentiality Agreements (NDAs):

Confidentiality agreements, also known as Non-Disclosure Agreements (NDAs), are legal contracts designed to protect sensitive information shared during the acquisition process. They ensure that both parties—typically the buyer and seller—agree not to disclose or misuse confidential business data, such as financial records, trade secrets, proprietary processes, or strategic plans. NDAs are crucial to maintaining the integrity of negotiations by ensuring that any sensitive information shared does not end up in the hands of competitors or other external parties.

Key Aspects of NDAs:

- Protection of Sensitive Information: NDAs safeguard confidential data, including financial details, trade secrets, and strategic business plans, ensuring they remain undisclosed.

- Legally Binding: These agreements are enforceable by law, and any breach can result in legal and financial penalties.

- Clear Boundaries: NDAs specify what constitutes confidential information, the time period for confidentiality, and limitations on the use and disclosure of shared data.

- Trust Building: By committing to confidentiality, NDAs foster a secure environment for open discussions, crucial for successful negotiations.

- Risk Reduction: NDAs prevent potential damage to a company’s competitive advantage or stock value by protecting sensitive information during the acquisition process.

- Market Protection: Avoid the premature release of critical financial or strategic information that could harm the companies involved or create market instability.

An NDA ensures that sensitive information remains protected, creating a foundation of trust and facilitating smooth negotiations throughout the acquisition process.

B. Cooling-off Period Agreement:

A cooling-off period agreement is a mutually agreed break in negotiations during an acquisition process, designed to give both parties time to pause and reassess their positions before making a final commitment. It is particularly useful when discussions are intense, and emotions may run high, or when the deal involves complex or high-stakes transactions.

Key Features of Cooling-off Period Agreements:

- Time to Reassess: The cooling-off period allows both parties to step back, reflect on the negotiation terms, and ensure they are fully aligned on all aspects of the deal.

- Preventing Impulsive Decisions: By taking a pause, both sides can avoid hasty decisions made under pressure, which could lead to unfavorable outcomes.

- Revisiting Terms: This break offers a chance to reconsider any terms, negotiate adjustments, and clarify points that may have been rushed in earlier discussions.

- Mitigating Risks: Especially in high-value or high-risk acquisitions, this period allows both parties to analyze long-term implications and potential risks without the influence of external pressure.

- Promoting Clearer Decision Making: It helps both sides evaluate the deal with a fresh perspective, ensuring that decisions are made thoughtfully and based on comprehensive understanding.

Overall, a cooling-off period provides valuable time for reflection and strategic alignment, promoting well-considered decisions and enhancing the chances of a successful acquisition.

C. Six-Month Confidentiality Clause:

The Six-Month confidentiality clause is a key part of the acquisition process, ensuring that both parties involved in the transaction do not disclose or confirm any details to external parties during the first six months. This period is critical for protecting sensitive information, managing risks, and maintaining stability during the early stages of the acquisition.

This clause mandates that both parties:

- Agree to keep the acquisition details confidential for a period of six months from the agreement’s effective date.

- Avoid disclosing information to external parties, including the media, competitors, and other stakeholders.

- Protect sensitive information and prevent early leaks or external influence.

- Ensure smooth negotiations and post-acquisition transitions during a crucial period.

This clause is designed to maintain control over the communication of sensitive information and to ensure a smooth process as both companies work through the acquisition.

The Consequences of Neglecting Step 2 in the Acquisition Process:

- Sensitive information may be exposed to competitors or the public.

- Confidential data could be mishandled or misused.

- Legal consequences such as lawsuits or penalties could arise.

- Rushed decisions may lead to unfavorable outcomes.

- Lack of a cooling-off period may prevent necessary reevaluation.

- Premature leaks could destabilize the acquisition process.

- Trust between parties could diminish, harming negotiations.

- Incomplete information could result in poor decisions.

- Misunderstandings of terms could cause conflicts later.

Step-3

2.3. Due Diligence:

Due diligence is a critical phase in the acquisition process, where the acquirer investigates and verifies the target company’s financial, legal, operational, and compliance status. The goal of due diligence is to ensure that the acquirer has a complete understanding of the risks, opportunities, and overall condition of the target company before moving forward with the transaction. A thorough due diligence process provides the acquirer with key insights that can guide decisions, highlight potential risks, and confirm that the deal aligns with strategic objectives.

- Financial Due Diligence:

Financial due diligence focuses on analyzing the financial health of the target company. This step involves a detailed review of the company’s financial statements, including profit and loss accounts, balance sheets, and cash flow statementProfit & Loss Statements

Key Documents to Review:

- Profit & Loss Statements

- Balance Sheets

- Cash Flow Statements

- Tax Returns

Objectives:

- Verify the accuracy of reported financial performance

- Uncover any hidden financial issues or liabilities

- Assess the company’s true financial standing and future viability

Focus Areas:

- Revenue projections and stability

- Existing debts and liabilities

- Off-balance-sheet liabilities

- Cash reserves and liquidity

Overall, the due diligence process is fundamental to an informed decision-making process during acquisitions. By examining the financial, legal, statutory, and human resources aspects, the acquirer can ensure that they are fully aware of any risks or liabilities associated with the target company. This insight enables the acquirer to make a well-informed decision and negotiate terms that reflect the true value and risk of the acquisition.

The Consequences of Neglecting Step 3 in the Acquisition Process:

- Unclear terms lead to confusion and potential disputes.

- Legal liabilities may arise from unresolved debts or claims.

- Intellectual property protection may be neglected, risking valuable assets.

- Regulatory and compliance issues could result in penalties or legal action.

- Employee disputes may arise over contracts, compensation, or integration.

- Undiscovered risks could surface, causing unexpected post-acquisition issues.

Drawing Up the Risk:

After the due diligence phase, it is crucial to consolidate findings and identify potential risks associated with the acquisition. This step involves listing all risks uncovered during the due diligence process to gain a clear understanding of their nature, severity, and potential impact on the deal and future operations.

Key Steps in Drawing Up the Risk:

- Categorize risks based on areas such as financial, legal, statutory, operational, and human resources.

- Assess the severity of each risk by evaluating its likelihood and potential impact.

- Highlight critical risks that require immediate attention, such as unresolved liabilities or non-compliance issues.

- Document all identified risks clearly and in detail for stakeholders’ review.

- Objectives:

- Provide transparency about potential challenges.

- Create a reference for prioritizing and addressing key risks in subsequent steps.

- Ensure all risks are acknowledged and considered in decision-making.

Quantum to Define Risk:

Defining the quantum of risk involves quantifying the identified risks in terms of their financial and operational impact. This helps to prioritize mitigation efforts and prepare the organization for worst-case scenarios.

- Steps to Define Risk Quantum:

- Financial Impact: Estimate the monetary implications of each risk, such as penalties, lawsuits, or operational disruptions.

- Operational Impact: Evaluate risks’ effects on business continuity, productivity, and employee engagement.

- Strategic Impact: Consider long-term implications, such as reputational damage or competitive disadvantage.

- Use scoring models or risk matrices to rank risks based on probability and impact.

- Objectives:

- Assign measurable values to risks for better understanding and comparison.

- Support effective decision-making with data-backed insights.

- Determine resource allocation for addressing high-priority risks.

Risk Mitigation Process

The risk mitigation process focuses on developing and implementing strategies to address and minimize the impact of identified risks. This ensures that risks do not derail the acquisition process or jeopardize post-acquisition integration.

- Key Steps in Risk Mitigation:

- Prioritize Risks: Focus on addressing high-probability, high-impact risks first.

- Develop Action Plans: Create specific strategies for mitigating each risk, such as renegotiating contracts, improving compliance efforts, or addressing cultural integration challenges.

- Monitor Implementation: Assign accountability for mitigation actions and establish timelines.

- Build Contingency Plans: Prepare alternative solutions for risks that cannot be fully mitigated.

- Engage Stakeholders: Communicate risks and mitigation plans to key stakeholders to ensure alignment and readiness.

- Objectives:

- Proactively address risks to prevent complications during or after the acquisition.

- Strengthen confidence in the acquisition process by showing readiness to tackle challenges.

- Ensure smooth integration and long-term stability of the combined organization.

By systematically identifying, quantifying, and mitigating risks, the acquirer can address potential challenges uncovered during due diligence. This approach ensures a proactive stance toward managing uncertainties, safeguarding the acquisition’s value and objectives. Effective risk management minimizes disruptions, builds stakeholder confidence, and sets the foundation for a successful integration and future growth.

Step-4

2.4 Valuation and Negotiation:

Negotiation is a pivotal stage in the acquisition process where both parties finalize the terms of the deal. The negotiation phase involves a detailed discussion of various critical aspects, such as company valuation, payment methods, debt handling, operational responsibilities, and risk-sharing mechanisms.

- Valuation and Payment Structures: The first major focus is determining the target company’s value, which will shape the payment structure. Payment can be made through cash, stock, or a combination of both, and negotiations ensure that both sides agree on a fair valuation based on due diligence findings.

- Treatment of Outstanding Debt: Another important point of negotiation is how any existing debt or liabilities of the target company will be handled. This could involve paying off the debt, assuming it, or restructuring it as part of the deal.

- Division of Operational Responsibilities: The parties must also agree on how operations will be divided post-acquisition, including leadership roles, employee integration, and management responsibilities.

- Risk-sharing Model: Both parties must agree on how to allocate risks for future liabilities, such as unresolved legal issues or potential financial losses. A clear risk-sharing framework ensures that both parties are prepared for unforeseen events.

- Risk Mitigation Model: The risk mitigation model outlines strategies to address and minimize identified risks, ensuring both parties are prepared to handle challenges post-acquisition. It defines the allocation of responsibilities for specific risks, such as legal disputes or financial liabilities, and includes contingency plans for potential worst-case scenarios. Regular monitoring and review mechanisms ensure effective implementation and adjustment of the mitigation strategies over time.

Skilled negotiators and experienced advisors play a crucial role

in ensuring that all terms are clearly defined, minimizing potential conflicts, and ensuring that both sides benefit from a mutually agreeable deal. Successful negotiation sets the foundation for a smooth integration and a successful acquisition.

The Consequences of Neglecting Step 4 in the Acquisition Process:

- Incorrect valuation leads to overpaying or underpaying for the company.

- Unexpected liabilities or creditor conflicts due to debt issues.

- Disagreements over leadership roles and management responsibilities.

- Poor employee integration causes dissatisfaction and turnover.

- Legal risks, including lawsuits or fines from unresolved issues.

- Disruption of business operations due to unclear responsibilities.

Step-5

2.5. Critical Acquisition Agreements:

These agreements, including the Share Purchase Agreement, Share Transfer, and Agreement of Indemnification, form the legal foundation of the acquisition process. They ensure a smooth transfer of ownership, clarify liabilities and protect both parties from potential future risks associated with the transaction.

A. Agreement of Share Purchase:

The Share Purchase Agreement (SPA) is a legal contract that formalizes the transfer of ownership of a company’s shares from the seller to the buyer. This agreement serves as the foundation for the acquisition and outlines key terms, including the price, payment structure, conditions precedent, warranties, and indemnities. A well-structured SPA ensures a transparent and smooth transaction, mitigating the risks associated with the acquisition and protecting both parties involved.

Key Components of a Share Purchase Agreement:

- Price and Payment Terms: The SPA specifies the agreed-upon price for the shares being transferred and the payment structure. It outlines how the purchase price will be paid, whether in full or in installments, and may also include provisions for performance-based payments or adjustments based on post-closing financial results.

- Conditions Precedent: The agreement also outlines the conditions that must be met before the transaction is finalized. These could include regulatory approvals, due diligence results, or clearance from any relevant authorities. If any conditions are unmet, the transaction may be delayed or canceled.

- Warranties: Warranties are promises made by the seller regarding the condition of the company being sold. These warranties may include claims about the accuracy of financial statements, ownership of shares, legal standing of the company, and compliance with laws. If any warranties are breached, the buyer may seek compensation.

- Indemnities: Indemnities provide the buyer with protection in case of future liabilities arising from events before the acquisition. The seller agrees to compensate the buyer for any potential losses caused by undisclosed risks, such as hidden liabilities or legal claims.

Compliance with the Companies Act, 1994:

In Bangladesh, adherence to the Companies Act, of 1994 is crucial when drafting a Share Purchase Agreement. This legal framework ensures the transaction is carried out in compliance with local laws and regulations, such as procedures for the transfer of shares and the required approval from the company’s board of directors. Proper documentation ensures the legitimacy of the transfer and reduces the risk of legal disputes in the future.

Overall, the Share Purchase Agreement is a vital instrument in ensuring the buyer’s and seller’s interests are protected throughout the acquisition process. By addressing all aspects of the transfer, including price, terms, and legal safeguards, the SPA creates a structured and legally binding transaction.

B. Share Transfer to the Acquiring Company:

The share transfer process is a critical step in completing an acquisition, where ownership of the company is formally transferred from the seller to the acquiring company. In Bangladesh, this process involves key steps, including registration with the Registrar of Joint Stock Companies and Firms (RJSC) and obtaining necessary securities exchange approvals, to ensure compliance with legal and regulatory standards.

Steps Involved in Share Transfer:

- Registration with the RJSC: Once the Share Purchase Agreement (SPA) is signed, the transaction must be registered with the RJSC. This registration formalizes the change in ownership and ensures that the acquiring company is listed as the new shareholder in the company’s official records. The company must submit necessary documents such as the signed SPA, board resolutions, and other required information to the RJSC.

- Filing for Approval: The acquirer may need to file specific forms with the RJSC, including notification of the share transfer. The RJSC verifies that the share transfer complies with the relevant provisions of the Companies Act, 1994, and may require supporting documentation, such as proof of payment or clearance from other government authorities.

- Securities Exchange Approval: If the acquired company is listed on the stock exchange, acquiring shares will also require approval from the securities exchange to ensure the transfer complies with regulations. This may include securing permission from the Bangladesh Securities and Exchange Commission (BSEC) and submitting the necessary documentation for relevant permission as applicable.

- Compliance with Legal and Tax Regulations: In addition to securing RJSC and exchange approvals, the transaction must meet tax obligations. This might include ensuring stamp duty is paid on share transfers or complying with other regulatory requirements to avoid any legal implications.

By completing the registration and obtaining necessary approvals, the transfer of shares is officially recognized, securing the acquisition’s legitimacy. These steps, conducted in accordance with Bangladesh’s legal framework, ensure that the transaction is transparent, complies with all local regulations, and is enforceable. This formalization of ownership is a fundamental step in ensuring a successful acquisition and a smooth transition for both the acquiring company and the target business.

C. Agreement of Indemnification During the Acquisition Process:

An indemnification agreement is a critical component of the acquisition process designed to protect the buyer from potential liabilities or financial losses resulting from events that occurred before the acquisition. This agreement is especially important in markets like Bangladesh, where variations in industrial practices, financial records, and compliance with labor laws could pose unforeseen risks.

Indemnification clauses allocate responsibility for certain risks, typically ensuring that the seller will cover or compensate the buyer for certain losses arising from pre-existing issues. These can include legal disputes, environmental violations, employee claims, and tax liabilities, all of which could arise after the acquisition is finalized.

Key Aspects of Indemnification Agreements:

- Protection for the Buyer: The buyer is safeguarded from financial and legal risks related to the target company’s historical actions. For instance, if undisclosed liabilities or legal claims emerge after the acquisition, the seller is responsible for covering the associated costs.

- Scope of Indemnification: The indemnity agreement should define the specific risks that are covered, such as breach of contracts, environmental violations, unpaid taxes, employee grievances, or intellectual property issues. It outlines the extent of protection the buyer will receive and under what conditions.

- Limitations and Caps: To prevent excessive claims, indemnification agreements often establish limitations, such as financial caps on the amount the buyer can claim from the seller, or a time frame within which claims must be made. These restrictions help balance the risks between the parties involved.

- Post-acquisition Discoveries: In some cases, indemnity clauses also cover risks that the buyer may not uncover during due diligence but may surface post-acquisition. This is especially pertinent if hidden liabilities or legal issues are discovered after the deal is closed.

In markets like Bangladesh, where regulatory compliance can vary significantly across industries, indemnification clauses offer essential protection to buyers, ensuring that they do not inherit undisclosed liabilities or legal issues from the target company. By agreeing to a well-structured indemnification clause, both parties can move forward with greater clarity and security, helping to facilitate a smoother transaction and mitigate potential risks.

The Consequences of Neglecting Step 5 in the Acquisition Process:

- Invalid ownership transfers due to lack of proper SPA.

- Payment disputes from unclear terms or payment structure.

- Regulatory non-compliance causing penalties or delays.

- Legal liabilities from undisclosed issues.

- Financial loss from unprotected hidden liabilities.

- Delays in transfer process causing disruptions.

- Ownership confusion due to improper registration.

- Inability to enforce transaction without approval.

- Tax and legal penalties from non-compliance.

- Post-acquisition risks from uncovered liabilities.

Step-6

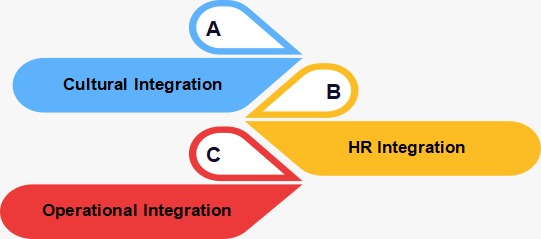

2.6. Post-Transfer Integration:

Post-transfer integration is the final and most crucial phase of an acquisition. It involves aligning the acquired company’s operations, workforce, culture, and systems with those of the acquiring company. Successful integration ensures that the acquisition maximizes its potential, both operationally and culturally, by unifying different entities and maintaining effective coordination across all aspects of business. Below are the key components of a successful post-transfer integration.

A. Cultural Integration

The cultural integration aspect focuses on blending the workplace cultures of the two companies to minimize friction and foster an environment conducive to cooperation and mutual respect.

- Conducting Workshops and Training: Workshops or training sessions help familiarize employees from both companies with the values, expectations, and goals of the parent company. These can be held as introductory programs where employees learn about each other’s operational styles, work ethics, and corporate cultures.

- Fostering Trust Among Teams: Building relationships and trust is essential for a smooth transition. This involves clear communication from leadership about the vision, goals, and strategic benefits of the acquisition, assuring the workforce of their job security and role in the new organization. Ensuring that the acquired company’s culture is respected helps mitigate resistance to change and fosters collaboration.

- Addressing Conflict Resolution: Ensuring that differences in company culture do not create conflict is crucial. Establishing channels for open communication and conflict resolution mechanisms can address cultural clashes, ultimately promoting a more harmonious working relationship.

B. HR Integration:

Human Resource (HR) integration focuses on aligning the employee structures and practices between the acquiring and acquired companies.

- Harmonizing Payroll and Benefits: A key component is the integration of payroll systems to ensure consistency in employee compensation, tax deductions, bonuses, and benefits across both companies. Adjustments may be required if there are disparities in salary structures, employee benefits, or pension schemes.

- Aligning Policies with Labor Laws: In countries like Bangladesh, where labor laws such as the Bangladesh Labor Act, 2006 govern worker rights, aligning HR policies between the companies is essential. This alignment ensures that both organizations meet statutory obligations related to employee welfare, workplace safety, working hours, and dispute resolution.

- Talent Retention and Engagement: After an acquisition, it is crucial to retain key talent from the acquired company to ensure continued business operations and knowledge transfer. Initiatives may include offering retention bonuses, restructuring incentive plans, and outlining career growth opportunities within the newly integrated structure.

- Identify Crucial Roles and Assess People Manning this Roles: Identifying critical roles and assessing the individuals in these positions is essential for successful HR integration. This involves analyzing key roles critical to operations and strategy and evaluating employees’ skills, performance, and alignment with organizational goals. Addressing skill gaps and retaining top talent through targeted incentives ensures continuity and leverages expertise during the integration process.

C. Operational Integration

Operational integration focuses on aligning the business processes, systems, and technology used by both companies to ensure efficiency and reduce redundancy. It is crucial in achieving the long-term success of the acquisition.

- Unifying IT Systems and Operational Processes: One of the primary challenges of post-transfer integration is the alignment of IT infrastructure. The acquired company’s IT systems, which could range from accounting software to CRM solutions, may need to be integrated with the parent company’s systems. Data migration, system compatibility checks, and training for employees on new technologies can ensure smooth operations. Upgrading or replacing legacy systems could also improve operational efficiency.

- Streamlining Supply Chain Management: Post-integration also includes analyzing the supply chains of both companies. Identifying overlaps, eliminating redundancies, and improving procurement processes can result in cost savings. Standardizing procedures across the combined companies helps ensure seamless operations.

- Addressing Redundancy: Sometimes, operational overlaps occur after an acquisition, which may lead to redundant roles or processes. Redundancy analysis helps streamline the workforce by identifying and eliminating non-essential positions or inefficient processes. Clear communication on redundancies helps manage employee expectations and allows for smoother transitions while maintaining operational performance.

- Leveraging Synergies for Efficiency: The goal of operational integration is to identify synergies that help improve overall efficiency. This may involve merging departments such as finance, marketing, and procurement, aligning production schedules, or consolidating office spaces to reduce costs and improve productivity.

Post-transfer integration ensures that the combined entities operate smoothly as a unified unit. Through effective HR integration, cultural alignment, and operational unification, the process plays a crucial role in the success of the acquisition. Careful planning, clear communication, and resource allocation are essential for the acquired company to seamlessly integrate into the parent company. This integration unlocks new opportunities, enhances value, and fosters growth, enabling long-term business success, despite the challenges involved.

The Consequences of Neglecting Step 6 in the Acquisition Process:

- Inconsistent payroll, benefits, and legal non-compliance leading to dissatisfaction and potential legal issues.

- Difficulty in retaining key talent, causing knowledge gaps and operational disruptions.

- Workplace conflicts and lack of trust due to cultural differences, resulting in lower employee morale and resistance to change.

- IT system failures, data migration issues, and redundant processes causing inefficiencies and operational delays.

- Missed opportunities for synergies, leading to increased costs and reduced productivity.

Key Success Factors for Right Acquisition:

- Identify the right organization

- Understanding the organization from a culture and risk perspective

- Right valuation and negotiation

- Identify the value of the acquisition process

- Post-acquisition integration

- Right assessment of fixed and current assets

infinigent consulting Ltd

infinigent Consulting Ltd. is a multinational strategic management consulting firm operating in India, Canada, and Bangladesh, with plans to expand to Singapore and Dubai. Our diverse team of international and local experts delivers tailored solutions to address business challenges. By closely collaborating with clients, we focus on improving organizational performance through customized, effective strategies.